Article

What are the 4 types of stocks to trade?

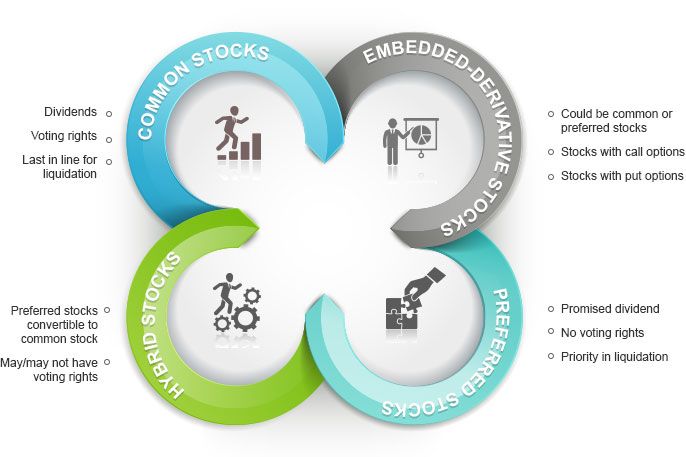

The four main types of stocks to trade are:

-

Common Stocks: Common stocks are the most prevalent type of stocks traded in the stock market. When people talk about buying or trading stocks, they are usually referring to common stocks. By owning common stocks, investors become partial owners of the company and have voting rights in shareholder meetings. They also have the potential to receive dividends, which are a portion of the company's profits distributed to shareholders. Common stocks offer the highest potential for capital appreciation, but they also carry higher risks compared to other types of stocks.

-

Preferred Stocks: Preferred stocks are another type of ownership in a company, but they differ from common stocks in several ways. Preferred stockholders have a higher claim on the company's assets and earnings than common stockholders, meaning they are paid dividends before common stockholders. However, preferred stockholders usually do not have voting rights. Preferred stocks generally offer a fixed dividend rate, which makes them more similar to bonds in terms of income generation. They are often considered a hybrid between stocks and bonds.

-

Blue-Chip Stocks: Blue-chip stocks refer to stocks of large, well-established, and financially stable companies with a history of reliable performance. These companies are usually leaders in their industries, have a long track record of success, and often pay dividends. Blue-chip stocks are considered relatively safer investments compared to smaller or less-established companies, making them attractive to conservative investors.

-

Small-Cap, Mid-Cap, and Large-Cap Stocks: Stocks can also be categorized based on the market capitalization (market cap) of the company. Market cap is calculated by multiplying the stock's current share price by the total number of outstanding shares. The three main categories are:

-

Small-Cap Stocks: These are stocks of smaller companies with a lower market capitalization. They typically have more growth potential but are also associated with higher risks due to their smaller size and potential volatility.

-

Mid-Cap Stocks: These are stocks of medium-sized companies that fall between small-cap and large-cap stocks in terms of market capitalization. They are often seen as a balance between growth potential and stability.

-

Large-Cap Stocks: Large-cap stocks belong to well-established, big companies with a high market capitalization. These companies are usually industry leaders and are considered more stable and less risky than smaller companies.

-

Traders and investors can choose from these different types of stocks based on their investment goals, risk tolerance, and time horizon. It's important to conduct thorough research and consider individual financial situations before making any investment decisions in the stock market.